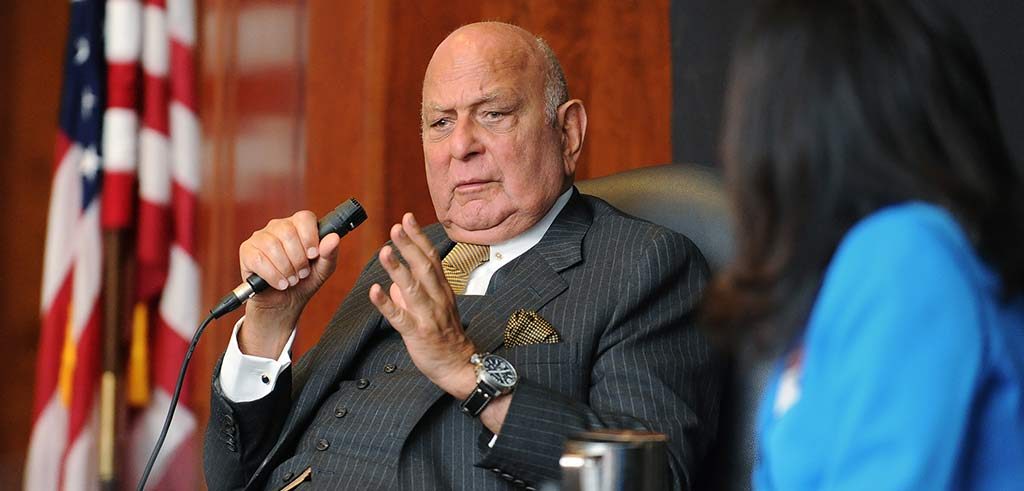

Nemir A. Kirdar, executive chairman and CEO of private equity investment group Investcorp, told Fordham students on June 3 to cultivate their “reputational capital” carefully as they embark on business careers.

“That’s the one that is the biggest capital anybody can have to safeguard his own future,” he said.

“When [Investcorp] calls a customer and says ‘We have an investment to offer you,’ immediately we get an appointment. That says to me that [our]work has been synonymous with that reputational capital. We are welcomed because we built the trust and respect of that client base.”

Kirdar, who received his MBA from the Gabelli School of Business in 1972 and was awarded an honorary doctorate last year, was the guest of Fordham’s Wall Street Council, which brings together business faculty, staff, students, and friends interested in the various sectors of the capital markets. The event was sponsored by Thomas Galvin, GABELLI ’83.

In a Q&A session with Donna Rapaccioli, PhD, dean of the Gabelli School, Kirdar reflected on his long career in banking and investment, the state of his a native Iraq, and the intricacies of doing business in the Middle East.

Kirdar said he looked to Fordham for his MBA because he’d attended a Jesuit high school in Iraq, and therefore knew it would be a great education. The two years he spent earning his MBA while working full-time at Allied Bank International were very difficult, he said, and he saluted several attendees in the room doing the same.

“If you have that kind of conviction and determination, that’ll take you a long way in the future,” he said.

In fact, he said he though a lot about those difficult years when he wrote his most recent book, Need, Respect, Trust: The Memoir of a Vision (Orion Publishing, 2014), he said.

“I define leadership not by the positions you’ve occupied, but by the obstacles you have overcome. So for those who are doing it the hard way, that’s one of the obstacles and it shows your determination.”

Before Kirdar founded Investcorp, which specializes in global alternative investments such as private equity, hedge funds, real estate, and Persian Gulf growth capital, in 1982, he worked for Chase Manhattan Bank. Asked what he thought about banking regulations today, he said it helps to remember what life was like during the 2008 financial crisis.

“After that experience, a great deal of regulation has been put forward. I would not consider those as obstacles. They’re there to create the groundwork of principles of what is doable or not. Banks have more equity now than before the crisis, and I think that’s healthy,” he said.

When it comes to investing, Kirdar said that Investcorp looks for long-established companies that haven’t performed as well as they once did, and tries to find out how they can recapture that success.

“We really rely on companies that have brand names and track records in their own marketplace, but today [many]are not doing well because of some reason.

“If we can find the reason, they we can sell the past of the company,” he said.

He expressed optimism for the future of the Gabelli School, which was unified this year with Fordham’s graduate school of business under the leadership of Dean Rapaccioli.

“I’ve spent a lot of time in these hallways and I have a big place in my heart for Fordham,” he said. “I’m proud to be here, I’m proud to see you, and I’m proud to share with you my own experience.”